So hello friends, today we are going to talk about how to fill HDFC Bank KYC Form , as you must have known in our previous post that what is KYC Form and why it is important but if you are new to our blog and do not know So let's talk a little bit about KYC Form .

So its full form is Know Your Customer ( the process of knowing your customer or knowing your customer ) is called KYC, so friends as we all know that to run any big organization, a system is needed so that In view of this, KYC Form is used in almost all banks , so that everything can go on smoothly and smoothly even further .

By its use, the Bank retains the accurate and accurate identity of the Customer with the Bank, including the Customer's Full Name , Date of Birth , Photo, Customer's Full Address , Pin Code , Customer's Signature or Thumb , Father 's as the Customer's identity. Or include information such as husband 's name , phone number , etc.

There are generally two ways to do KYC, 1 offline and 2 online.

So first of all we tell you about how to fill HDFC Bank KYC Form offline. HDFC BANK KYC FORM You can also download the form from this link.

How to do HDFC bank offline KYC ?

Contents

- First of all, show you how HDFC Bank KYC form is. So if we want to do KYC in offline way, then we have to fill the above form with the information asked in it and also add some necessary documents with it. has to be deposited in You can also download this KYC Form from the link given above and get a print out of that downloaded KYC Form from any nearby shop, and can also get it from HDFC Bank.

So know how to fill this KYC Form. We have divided this KYC form into four parts, so that it is easy for you to understand.

PERSONAL

In this section, we first fill the customer id which is written in your passbook, then after that the account no. That too is written in your passbook itself, after that the customer name like Mr./Miss/Mrs then after this the full name like if someone's name is Manoj Kumar Verma then Manoj Kumar in first name in middle name and Verma in last name will come in.

OCCUPATION AND INCOME

Talking about this section, in this we have to give information related to our business and income. Like what work we do, the name of the business from which we get income, if you do any business then what is the nature of that business or if you work somewhere then the name of that company and how much salary you get from there .

A total of eight questions are asked in this section, which we will understand in turn,

- Occupation Here we have to give junkery related to our business and we have to tick the box which meets our business.

- Self Employed Since Here we have to fill that for how many days we are in that business.

- Nature of Business Here we have to fill that what kind of business we do.

- Type of Company / Firm Here we have to give this information whether the business we do is in partnership or it is in proprietorship, it is private limited or it is public limited.

- Self Employed Professional In this, we have to give this information that the person who has any skill of his own or earns from any of his skills such as Doctor, IT Consultant, Lawyer, CA / CS, Architect etc.

- Source of Funds Here we have to tell what is the source of our income such as Agriculture, Salary, Business Income, or Investment Income.

- Gross Annual Income Here we have to tell that how much is our income for the whole year, you can tick it according to what you have.

- Residence Type Here we have a button whether the house where we live is our own or is rented or has been provided by the company.

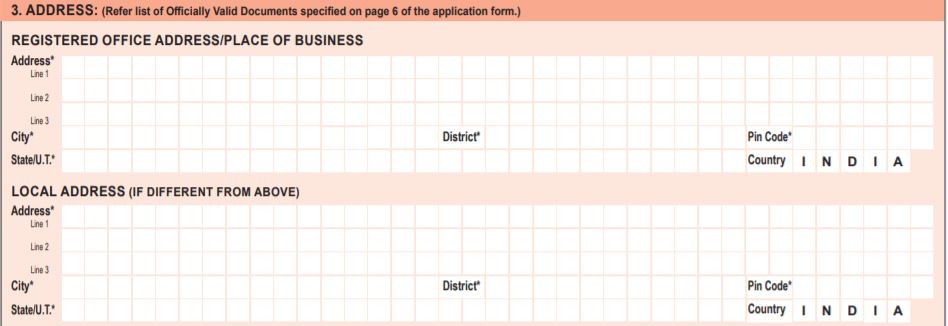

ADDRESS & CONTACT

On top of this you get two options out of which you have to tick one, first is There is no change in my mailing address and second is Wish to change my mailing address/contact details as below. The first one means that The address that you have given in the bank, you want to keep the same address and the second one means that you want to change the address, you can make your own selection.

If you tick the second one, then you will have to fill the full address section, in which you have to write what is the flat number, what is the road number, what is the landmark, what are the things around you, which is the city, which is your state, We have to fill information like mobile number, e-mail id, pincode. And if you want that our first address should be the same which you gave while opening the account. So just tick the first option, and you do not need to fill in the section containing the address again.

If you tick the second one, then you will have to fill the full address section, in which you have to write what is the flat number, what is the road number, what is the landmark, what are the things around you, which is the city, which is your state, We have to fill information like mobile number, e-mail id, pincode. And if you want that our first address should be the same which you gave while opening the account. So just tick the first option, and you do not need to fill in the section containing the address again.

DECLARATION

So here you just have to put your Aadhar Card in the Address Proof, and you have to put Pan Card in the Identity Proof, if you want, you can also put Voter ID. Your place of birth has to be filled in the place of the place and in the date, the date of the day on which you submit the form has to be filled. In Signature Of Account Holder, you have to put your signature, and where Please Affix Photo is written in a box, you have to put a passport size photo of yourself. And the bankers will see what FOR BRANCH USE ONLY would have written under it, there you do not have to disturb anything.

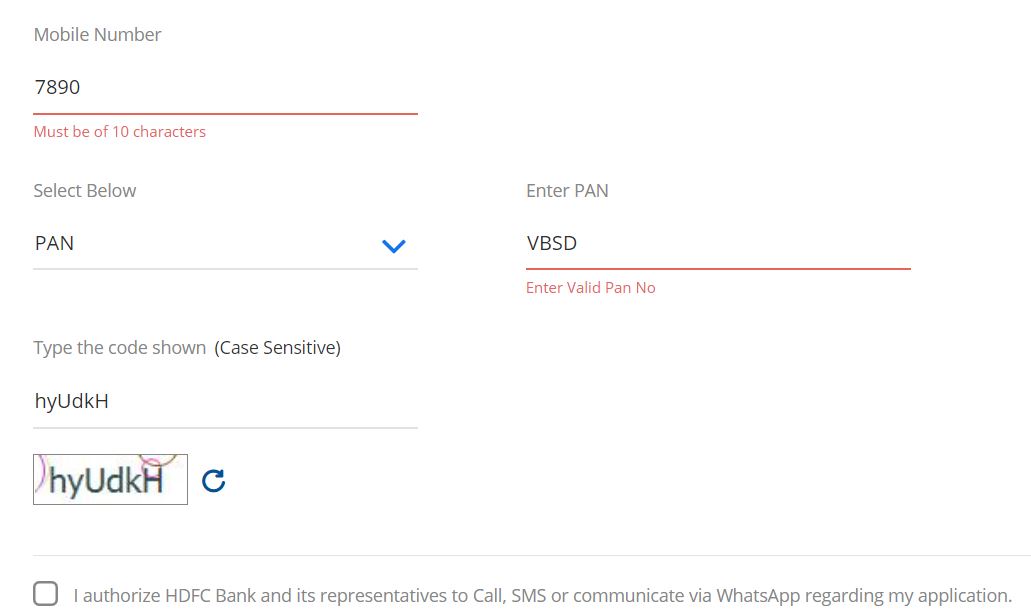

HDFC Bank KYC Form Online Apply

First you have to login by visiting HDFC Bank website , after login, click on request, then scroll down and go down there you will see Confirm KYC Details, click on it, you have to download the KYC Form given above. Will ask, and after filling it will ask to be scanned and uploaded, any one of the documents like Passport, Driving License, Voter card, Aadhar card, Job card by NAREGA will be asked as Document ID Proof.

Then you have to click on Continue, then you will be asked to fill the Customer Details, Address Details, you have to fill it, then you will be asked to change the address, if you want to change, then yes, otherwise do no. Similarly, you have to fill all the requested information there and your KYC is completed through video call from the bank.

Here it has been told that how to fill HDFC Bank KYC form and for this the easiest way has been explained in detail about all the options and through this you can fill KYC form in HDFC Bank and you can do this. After that you can activate your bank account completely. Hope you liked this information, if you have any question or suggestion about it, then definitely ask about it in the comment.

0 Comments